How much revenue did Buffer for Business generate in October, 2013? All stats and numbers

In October, we’ve been trying to push hard on the Buffer for Business front. Since we want to try and be as public and transparent about the things we’re doing, here are the full numbers about how Buffer for Business performed in October.

I’ve also emailed a new section to the team titled “Outlook and Thoughts” at the bottom, that I’ve included here. I

(For reference, here is the September report)

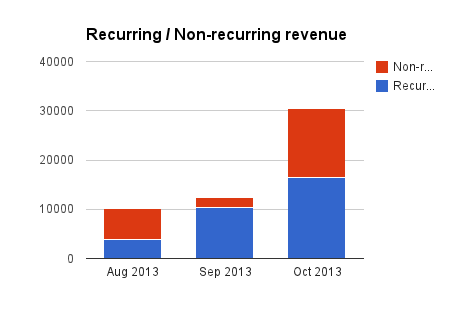

Revenue

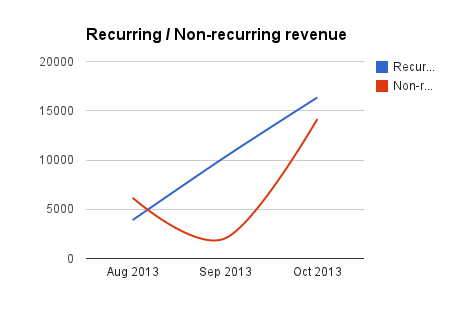

Recurring Revenue from June & July : $2100

Recurring Revenue from August: $4750

Recurring Revenue from September: $4850

+ 3x Yearly $510 = $1530;

+ 9x Yearly = $6630;

2 x $125 = $2550

1 $100 = $1020

6 $50 = $3060

+ 1 Enterprise = $6,000

Total recurring revenue October: = $16350

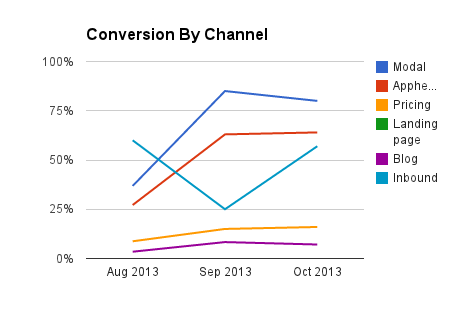

Conversions

There was a total of 103 new paying customers in October.

83 new people started paying in October from 379 trials started in October.

That’s a 21.6% conversion from trial to paying user.

Where did they come from?

80% of people coming from Modal converted (8 out of 10)

64% of people coming from Appheader converted (29 out of 45)

16% of people coming from Pricing page converted (23 out of 140)

10% of people coming from the landing page converted (16 out of 161)

7.1% of people coming from Blog converted (1 out of 14)

(57% of people coming from Inbound converted (4 out of 7)

Card details or not?

75% of people who had their card details already in converted to paying (60 out of 80)

9.6% of people who didn’t have their card details with us converted to paying (22 out of 299)

Numbers from September overflowing to October

- 21.6% of people who started a trial converted to paying users (82 out of 379)

- There were also 21 new paying customers who started paying in October, but whose trials started in September (from 69 trials in the last week of September)

- There were 595 new total trials started in October

Growth

- 59% increase in MRR compared to September (from $10300 to $16350) (MoM from July to August: 111%)

- 247% increase in total revenue compared to September (from $12340 to $30510) (MoM from July to August: 479%)

- Buffer for Business is 15.3% of total Buffer revenue in October (up from 7.1% last month)

- 6% decrease in new paying Business users in October (drop from 110 to 104)

- 79% increase in new trials started (From 332 trials in September to 595 in October)

Total users on Business

October:

Large ($250) x 5

Large 50% discount ($125) x 1

Medium ($100) x 9

Small ($50) x 89

Total new customers in October: 104

September:

Large ($250) x 2

Medium ($100) x 7

Small ($50) x 101

Total new customers in September: 110

:

Large ($250) x 9

Large 50% discount ($125) x 1

Old low agency ($200) x 2

Medium ($100) x 27

Small ($50) x 229

Total Business customers: 268 (compared to 164 in September, a 63% increase)

(not accounting for churn, unfortunately we’re not quite tracking that right now)

Outlook and thoughts

Buffer for Business is now fully automated: With the great work of Colin, Joel, Brian and the team, Buffer for Business is completely self-serve. I think this will give us a chance to focus more on other areas as there will be some more available time.

The downer for this month is that 6% less new people started paying. My hypothesis is three-fold.

- First, that we’ve not launched Business plans publicly yet, so there is little natural growth.

- Second, since they’re not launched, we’ve done little marketing for it, which we’ve decided will be a bigger focus for November.

- Third, we’ve not launched or added any more business specific features that would help with growth.

I believe that we’re working on all 3 of these areas so it’ll be interesting to see how our progress in November will be. With the set-back of the hack, seeing an uptick in growth rate might not be happening until December.

The plus point from this month is that Buffer for Business now makes up 15% of total revenue. I think that’s a great indication of how fast Buffer for Business can grow further.

A big impact on this month’s cashflow was also the addition of our first Enterprise customer which added $6,000 to Business revenues.

Try Buffer for free

140,000+ small businesses like yours use Buffer to build their brand on social media every month

Get started nowRelated Articles

Note: This is the quarterly update sent to Buffer shareholders, with a bit of added information for context. We share these updates transparently as a part of our ‘default to transparency ’ value. See all of our revenue on our public revenue dashboard and see all of our reports and updates here . It's been quite the y

Editor’s Note: Thanks for checking out this post! We’ve released our updated 2021 pay analysis here. You can’t improve something if you don’t know that it needs to be improved. That was very true for us four years ago when we first started looking into equal pay at Buffer. We have long used a salary formula to determine all of our salaries – the same role in the same part of the world receives the same salary. That m

Ever since the world got turned upside down by COVID-19, it’s been “business as unusual” for everyone – Buffer included. I sent this update out to Buffer’s investors one week ago. I hesitated on whether to share it more widely, as I know a lot of companies have been impacted more severely in these times. That said, I believe it makes sense to lean into our company value of transparency, since there may be some companies this could help, and it shows Buffer customers that we will be around beyon