We acquired Buffer.com: Here is how and why we did it

Disclaimer: It is only through the kind collaboration with the previous owner of buffer.com that we were able to now be the new owners, and a key interest for them was to stay anonymous and not to draw any attention to them in this announcement, which we are very keen to honor. So we have redacted all names and replaced them with “Bob” for the individual and “Company corp.” for the company name.

In similar interest to protect their privacy, the previous owner also wasn’t comfortable in sharing the price of this transaction, for various, very understandable reasons. This has also been a very interesting experience for us in terms of being fully transparent. As many of you know, we believe making everything about Buffer transparent, starting with salaries, equity, revenues, fundraising and so much more, is something that helps us build a better, more empathic and trustworthy company. At the same time, our values aren’t always the same values cherished by others, which is what we experienced here, and not forcing our own values onto someone else is a key thing to do, we felt.

So all things said, we tried to find a good balance of still sharing most of the details around how this happened and yet also honor the privacy of the previous owner with this announcement.

Introduction, by Leo: There was a great blogpost that Joel wrote on how to name your startup, where he mentioned that the domain name of your startup doesn’t matter. In fact, thinking about Buffer’s own domain history, we originally started out with bfffr.com, when Joel launched Buffer in late 2010.

Joel went on to change it to bufferapp.com, to make things more clear and worry less about not having the exact domain of your startup’s name, “Buffer” in our case. It can be a huge time-suck in the early days of your company, where your first and foremost goal should be to hit product-market fit and building something people want.

Spending time on acquiring a certain domain name could be a very futile exercise without a product that works. In fact, as Joel illustrates, most well-known companies all had “placeholder” domains for a long time before they got their actual name as their domain too:

- Square was squareup.com

- DropBox was getdropbox.com

- Facebook was thefacebook.com

- Instagram was instagr.am

- Twitter was twttr.com

- Foursquare was playfoursquare.com

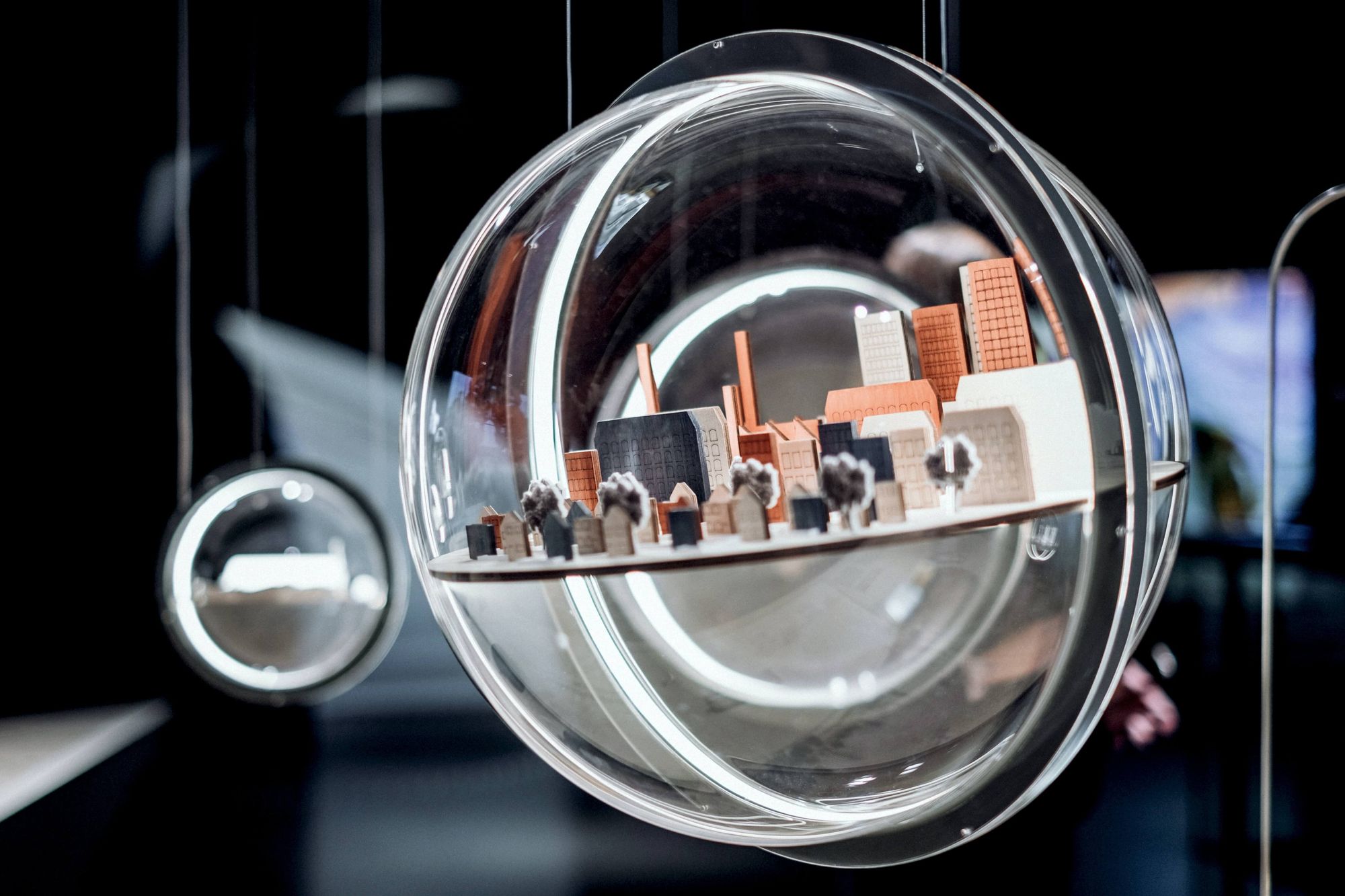

We felt that after we’ve established ourselves as a company that at this point generates over $5m/year, has over 30,000 paying customers and that sends around 700,000 social media posts every day on our users’ behalf, making our brand consistent and recognizable was an important step. So, for the last 1.5 years, we’ve been working on acquiring the domain Buffer.com.

On top of that, we felt that the longer we waited to buy the buffer.com domain, the more expensive it would get. Every year that Buffer would get bigger would mean that the owner could feel comfortable charging a higher sum. So going about it sooner rather than later felt right.

So our domain journey in short has been this:

bfffr.com -> bufferapp.com -> buffer.com

Here is the story of how it all happened.

First contact

Buffer.com was originally owned and registered by Company corp in 1997.

We first got connected when some of our customers landed on buffer.com and tried to call them to discuss a credit card charge, and Bob later told us that he was surprised since he did not usually deal with individual clients at his company. Bob went on to do some research and tried to call us, unfortunately we did not have a direct line for him to call, so he sent us an email about it.

We acknowledged being digital neighbors and worked out the issue around the confusion, although this would become more of an ongoing occurrence as Buffer grew bigger in size and more and more people thought that buffer.com was our domain.

Deciding on transparency for buying the domain

We then had a long discussion about how to go about possibly acquiring Buffer.com, after just having established contact with its owners. We asked some mentors for advice and also Googled about the topic. We found a few articles from domain acquirer experts and stories of how they did it.

A lot of them involved tactics like emailing from a Yahoo address, to hide your true identity to make yourself appear like a smaller company or letting a different entity altogether work on getting the domain. Of course all of this was aimed towards getting the smallest possible purchase price.

Recently—after we completed the buffer.com transaction—Bob told us that several people had previously approached him to buy buffer.com, emailing him from “personal emails” to make him offers, and he frequently had to decline.

We never felt that this was quite in line with our values and how Buffer has been doing business and I remember Joel being one of the most vocal to make sure we’d be doing things in a clean and transparent way. So instead of obscuring any of our intentions, we were as transparent as possible—to a point where we later on even showed the owners our bank account to help them understand why our offer to buy the domain at our stated price was the stated price.

Right from the get-go, it was clear to us, that the transparent approach would likely mean we would be paying a higher amount for the domain than we could have gotten away with through other strategies. We were ok with that, and our approach to be completely transparent with the owners was the one we were most comfortable and happy with.

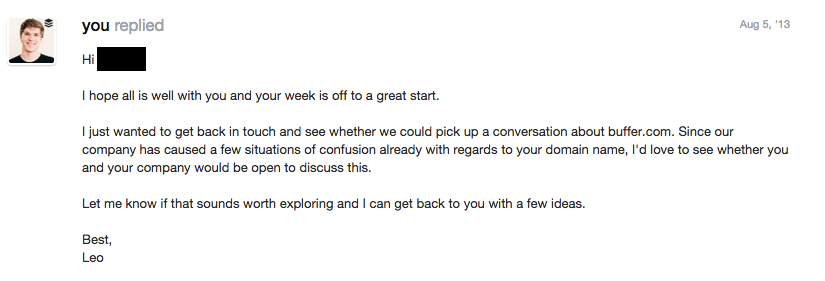

So a few weeks after the confusion with our voicemail, we reached back out to the owner, Bob, stating our intent as clearly as we could:

Their response was pretty clear, that they were open to chat, and at the same time, didn’t want to give up the domain for various reasons:

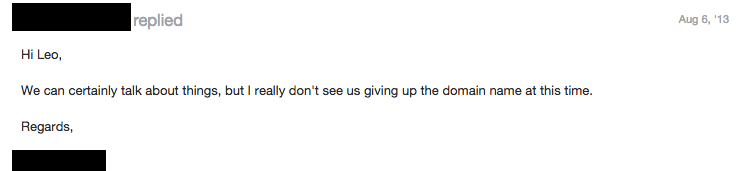

After a few back and forth emails, it was clear that Bob definitely wasn’t interested in giving up the domain at this point. It ended with this email which we didn’t get a response to, after which we got busy with other things:

Our initial offer clearly couldn’t have been a very exciting one, so we put things on hold for another 10 months, before Rodolphe came on board and started to pick things back up.

Enter Rodolphe, 10 months later, who picked things up and made it happen.

Rodolphe:

Re-Opening the conversation on Buffer.com

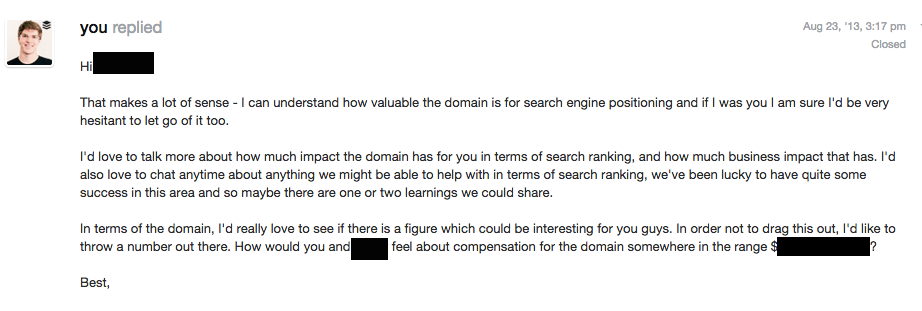

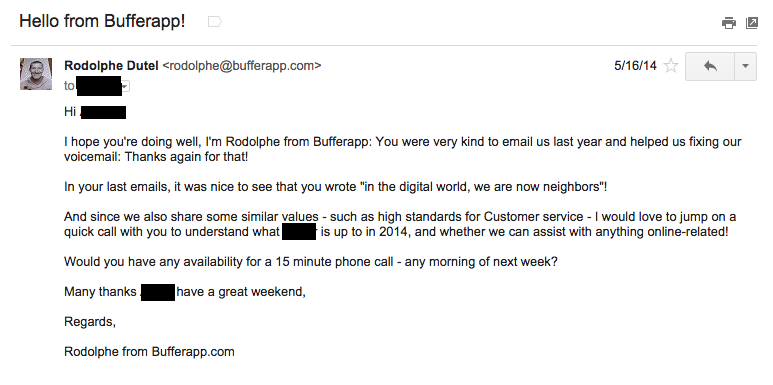

I joined Buffer in April 2014, jumping in to help with all things Business Development. About a month in, a Special Project came my way—trying to reconnect with Bob about buffer.com.

I took a couple of days to think on how to reconnect with Bob in the best possible way, and settled into writing an email to give some context to the discussion. It felt like a good opportunity to connect and start to know each other better – trying to provide some value through an intro email.

After sending this email, and a follow-up email about 10 days later – we didn’t quite manage to connect with Bob.

Since email didn’t really help us connecting, we felt like reaching out to Bob some other way: In June 2014, the amazing Nicole (who is looking after the Buffer community) called up Bob’s office to learn more about what he likes! Nicole sent a great hand-written letter to Bob together with a small voucher for his favorite coffee shop, as a token of appreciation.

This care package gave us a nice way to start a conversation. I called Bob in July 2014 and we had our first chat. It was great to hear that Bob remembered us, and he explained how buffer.com has been very useful in the past for his company to gain new business, since buffers is one of their most popular lines of business.

It was great to connect, although at that point when I asked about a possible price range, Bob said that he’ll consider it and that it was still “too early for now.”

Later on that summer, I called back to check on Bob. At that point, Bob shared that he would probably feel like holding on to buffer.com.

Meeting in person, getting closer

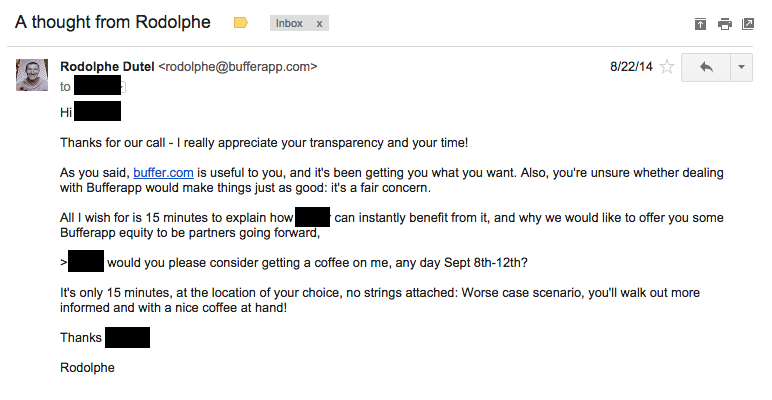

By chance, Buffer’s next retreat was planned to happen in NYC in September 2014, and Bob lived close to the city. So, since we would be present in NYC, we decided to see whether we might try to meet up and chat:

Meanwhile, Bob had gotten some more information about domain value through an acquaintance and suggested we came up with a number for him to consider:

We were buzzing with excitement, wondering what might happen next! Once we all got together in New York, I called Bob and we agreed to both do some thinking and meet up in person on a Friday.

On Thursday afternoon, Joel, Leo and I stepped out of the building and went out for a walk to discuss the best way to give Bob a fair offer. Hiten Shah, who was visiting the Buffer team, was also kind enough to offer some thoughts.

Pondering to up our offer and how much we were prepared to pay

At Buffer, we have been long-time advocates of the Lean Startup methodology (Eric Ries has invested in Buffer), it was quite a new discussion to explore purchasing an asset—even a virtual one—for a large portion of our available cash.

At the same time, we felt it was a very important component of our identity, and it would be such a nice addition to our service going forward.

We decided to be as transparent as possible in our approach, and to be as fair as possible. I went ahead and did some benchmark on a list of previously sold domains, how much they went for and when.

Buffer.com is a great domain, only six letters and it has a meaning in the English language. It was interesting to look at previous transactions. We also knew that Buffer.com is a little bit more “illiquid,” in the sense that some more generic domains such as color.com can be used in many different contexts, whereas we were likely to pay premium for Buffer.com as an asset that could be harder to sell for the same price we would pay for the transaction.

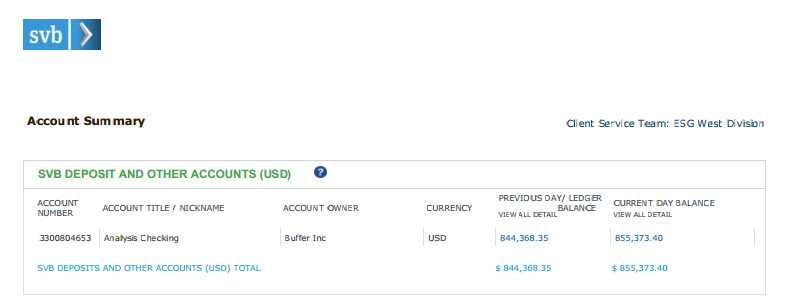

Also, we decided to give Bob all aspects of the Buffer story for him to have as much information as possible. On Thursday, we printed our balance sheet; we had $844,386 in the bank that day.

When Bob and I sat down for coffee, we had a great chat, and I got an opportunity to share our rationale:

- Our priority is to serve our Buffer users, and to guarantee payroll for Buffer employees.

- We wished to make the best offer we could on the day, without putting Buffer “at risk.”

- We shared our balance sheet for that day, together with the list of previously sold domains.

- We thought about the dollar amount, and percentage or our available cash that we would be willing to pay to acquire buffer.com.

Bob replied that he would consider it. He walked me back to the train station and I hopped on the train back to town towards Penn Station.

After we met, Bob and I kept in touch through some phone calls and emails for a few months.

Getting to a final number

Meanwhile, Buffer went on to raise $3.5m round at a $60m valuation in October, and we shared why and how publicly on this blog.

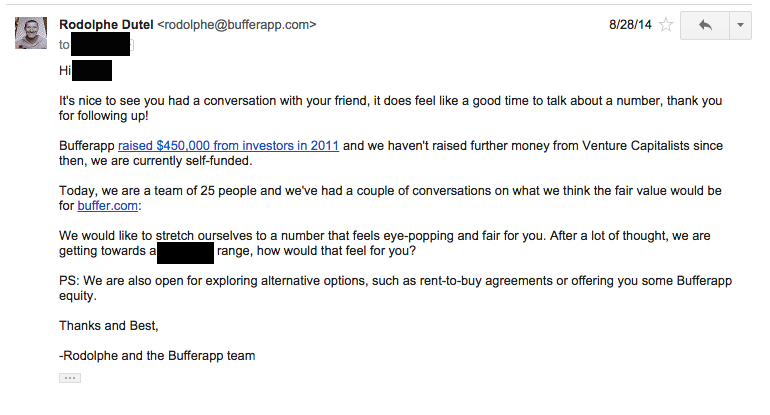

In early December 2014, Bob emailed us with a new number that he obtained based on the advice he had received and his own research.

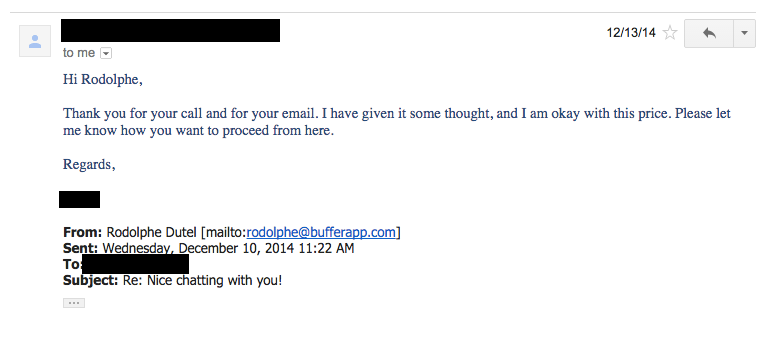

After some thoughts and conversations from both ends, we agreed on a price on December 13th!

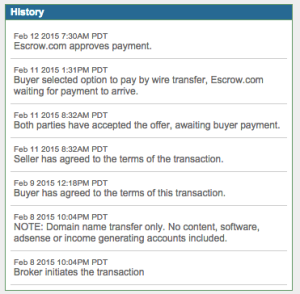

Throughout December 2014 and January 2015, our legal advisors over at WSGR and our accountants from Foresight assisted us to set up a domain transfer through Escrow.com – where the money would be held until the domain will be transferred.

We’re happy to announce that we now own buffer.com, and are very thankful to Bob for being such a great partner in this transaction! By giving the fresh domain a spin, we hope it makes using Buffer even more seamless.

Some stats on the Buffer.com transaction

- Emails sent: 16 (as of Feb 2nd 2015)

- Emails received: 8 (as of Feb 2nd 2015)

- Phone calls placed: 34 (dialing, not necessarily connecting – as of Feb 2nd 2015)

- Time elapsed between first contact and effective domain transfer: 624 days (June 5th 2013 – Feb 19th 2015)

Would love to hear your thoughts or questions on this in the comments. Hopefully sharing all our steps and the final outcome might also be helpful with your own efforts on getting the right domain for your projects and companies!

Try Buffer for free

140,000+ small businesses like yours use Buffer to build their brand on social media every month

Get started nowRelated Articles

In this article, the Buffer Content team shares exactly how and where we use AI in our work.

With so many years of being remote, we’ve experimented with communication a lot. One conversation that often comes up for remote companies is asynchronous (async) communication. Async just means that a discussion happens when it is convenient for participants. For example, if I record a Loom video for a teammate in another time zone, they can watch it when they’re online — this is async communication at its best. Some remote companies are async first. A few are even fully async with no live ca

Like many others, I read and reply to hundreds of emails every week and I have for years. And as with anything — some emails are so much better than others. Some emails truly stand out because the person took time to research, or they shared their request quickly. There are a lot of things that can take an email from good to great, and in this post, we’re going to get into them. What’s in this post: * The best tools for email * What to say instead of “Let me know if you have any questions” a